Retirees Age 65 and Older

Retirees Age 65 and Older

As a retiree of ORNL, turning age 65 is a major milestone: important changes occur in your benefits. At age 65, you become eligible for Medicare and your coverage under the ORNL UnitedHealthcare, MetLife and Delta Dental plans ends.

ORNL provides health care benefits to eligible retirees, spouses, and surviving spouses who are age 65 and older. ORNL has chosen Via Benefits to assist retirees with selecting individual health coverage in the Medicare market. As professionals in the health care insurance market (including coverage that works with Medicare), Via Benefits’ licensed benefit advisors will help you evaluate options and enroll in individual coverage that fits your budget and your unique medical, dental, and vision needs.

When you enroll in a Medicare Supplement plan through Via Benefits, ORNL will provide enhanced Medicare Part D prescription drug coverage, the ORNL Rx plan, so you will not experience a gap in drug coverage. That is part of standard Medicare Part D plans and is known as the donut hole. If you are eligible, ORNL will share in the cost of the plan by paying a portion of the ORNL Rx premium. Your share of the ORNL Rx premium is deducted from your pension check.

In addition, if eligible, ORNL will assist with the cost of health care coverage. When you enroll in a Medicare Supplement plan through Via Benefits and in the ORNL Rx plan, ORNL will provide benefit dollars through a Health Reimbursement Arrangement (HRA) that can be used to reimburse health care expenses including insurance premiums and other eligible out-of-pocket health care expenses.

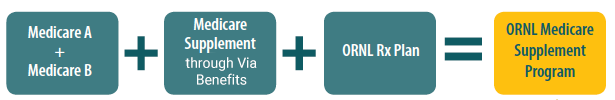

ORNL Medicare Supplement Program

Eligibility

As a retiree, when you reach age 65, your coverage under the UnitedHealthcare medical and MetLife or Delta Dental plans ends, and you are eligible to enroll in a Medicare Supplement plan and dental and vision coverage through Via Benefits. If you have a Health Savings Account (HSA), it will remain in effect for you to use for your eligible medical expenses.

Health Care Options

Learn how these parts combine to provide you with coverage.

WHAT YOU CHOOSE

Original Medicare pays for many, but not all, health care services and supplies. A Medicare Supplement Insurance policy can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

Medigap

Medigap plans are “standardized” policies identified in most states by letters A-N. All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. Different insurance companies may charge different premiums for the same exact policy. As you shop for a policy, be sure you’re comparing the same policy (e.g., compare Plan A from one company with Plan A from another company). Medigap SELECT policies, if available in your area, require you to use a network of hospitals, doctors, and other health care providers to get full coverage.

Medicare Advantage (Part C)

Medicare Advantage plans often include a drug plan with limited coverage and, because of Centers for Medicare & Medicaid Service rules, very few plans are available that coordinate with the ORNL Prescription drug coverage. In addition, some physicians do not accept these plans. Generally speaking, they are only available to ORNL retirees who live in a rural area. Via Benefits will help determine if a Medicare Advantage plan is available for you.

Dental or Vision coverage

Via Benefits offers separate dental and vision plans. The plans are not sponsored or supplemented by ORNL and enrollment is optional.

HOW TO DECIDE

You may combine the supplemental plans above to create a package of plans that covers all of your needs. Choosing the best combination requires some education and some comparison of plan features and costs. Via Benefits benefit advisors have the experience and knowledge to help. They can determine which plans are available to you and help you choose the best options.

How Health Reimbursement Arrangements Work

An HRA is an employer- provided health plan in which a single account is established for the retiree and spouse.

- When you enroll in individual medical coverage through Via Benefits, with the ORNL Rx plan, an HRA account will be established and benefit dollars will be allocated to the account.

- Your funds will be prorated based on the month you enroll.

- You can use the funds in your account to be reimbursed for premiums and/or your share of eligible health care expenses during the year. You decide how to use the benefit dollars in your HRA account.

- If you have an eligible spouse, you and your spouse will have a joint HRA account, and both you and your spouse may claim eligible expenses from the total amount in the account.

- Each year, an annual allocation will be made to the account in January. You will also be able to roll over unused benefit dollars from year to year, allowing you to accumulate dollars for future use.

Frequently Asked Questions

Resources

Contact Via Benefits

1-888-592-8348

Option #1: Enrollment—To enroll in a plan

Option #2: Customer Service—For questions about your plan, plan benefits, or the status of your application

Option #3: Funding—For questions about payments or your Health Reimbursement Arrangement (HRA)